There has been a lot of news recently about Bitcoin (BTC) and Litecoin (LTC).

If you’re not up to speed, Bitcoin is a virtual currency that you can use to buy real things in real life. There are many other websites that explain it in more detail, but as a virtual currency you can trade it the same as any other currency.

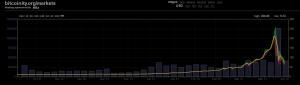

It’s been in the news recently because a few days ago there was a huge rally followed by a huge drop. Here’s a 6 month chart courtesy of bitcoinity.org:

You can see that 6 months ago Bitcoin was trading around $10 and last week it reached over $250 only to drop so much in one day that they actually halted trading, and then continue to drop to its current price (as of this writing) of $65. This got a lot of people interested who hadn’t even heard of BTC until a few days ago.

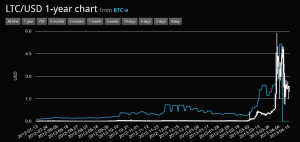

Litecoin (LTC) is a similar virtual currency, albeit one that is trading for much less, as you can see from this chart from cryptocoincharts.info:

For most of the last year it was well under $1, and then in the last week or so it ran up to a high of almost $6 and has now dropped to just under $2.

I am staying away from virtual currencies for now.

Why?

It has less to do with how viable I think they are as a legit form of currency and more with what a pain in the butt it is to work with them.

You may find that you’ve spent hours online reading about Bitcoin, Litecoin, and other virtual currencies, but realize you still have no idea how to actually invest in them.

Here’s roughly how it has to work (as of now):

First you need to find an exchange that lets you trade the instrument you want to trade. You can’t trade them at your normal brokerage, instead you need to find a site like MtGox or BTC-E and trade there. You may notice that difference exchanges have different prices for the same virtual currency. This is because it’s not centralized, and yes, there are arbitrage opportunities.

So you’ve found an exchange, the next thing you have to do is open an account and get money into it. How do you do that?

Well, you need something called an eWallet to store your Bitcoins. It’s basically a file that stores proof that you have the Bitcoins you have (the way this works is more complicated than I want to get into, so Google it if you want more info).

So how do you get money in your account so you can buy Bitcoin and put them in your eWallet?

You can’t use your credit card (chargebacks would screw over the seller).

You can’t necessarily use PayPal (not that you would want to with their huge fees, anyway). There is one option where you can but there’s like a 9% fee. More on this later.

BTC-E is one such exchange that lets you trade Bitcoin, Litecoin, and a few others. You can fund your account with a few online money-sending companies, one of which is in Russian, and the rest of which, well, you probably haven’t ever heard of them.

MtGox is another one that only lets you trade Bitcoin, but they are the biggest Bitcoin exchange on the internet, and have a few more options including a bank transfer.

There’s another option to fund your account called BitInstant. See, most funding options take forever. If you’re anxious to start trading today you don’t want to wait 5 days for the funds to end up in your account. BitInstant has a bunch of funds on reserve that they immediately transfer into your account after you pay them, and they take a small fee for the convenience. Unless you use PayPal, of course, in which case they take a 9% fee. It’s a clever idea, and they claim to have the funds in your account within hours, but due to the recent surge in BTC interest (and increase in BitInstant demand), there are reports on various forums of people still having to wait days with BitInstant.

There are other exchanges, but MtGox and BTC-E are probably the two most well known.

There’s also the issue of security. Some exchanges have been hacked. Some eWallets have been hacked. Some of these companies repaid their customers, which shows integrity.

Are you confused yet?

Basically, Bitcoin and its ilk only exist online, and you have to go through multiple websites to even fund your account. Many of these websites are not even US-based, and if for whatever reason your money never shows up in your account, who are you going to report it to?

Virtual currencies may end up being a very big thing in the future. After all, you can already buy some things with Bitcoin the same as you can with cash. And if you get in now at the ground level you may end up with some useable currency in the future. But I basically don’t trust any of the associated websites, and that’s nothing against them necessarily, it’s just my paranoia. And it also seems like quite a hassle to actually fund your account.

I do know people who have traded Bitcoin with MtGox and had no problem whatsoever. In fact, the statistics favor you having no problems whatsoever.

But I’m gonna sit tight for a while.

Prices may actually rally again in a few days when the people who just heard about it a few days ago finally get their accounts funded and start buying.