First trade today (not sure why the arrows aren’t showing up, so I drew them in with circles in MSPaint). OEC is a great brokerage but sometimes the options on the charting platform (such as showing order entries/exits) seem to randomly disable themselves, especially after upgrades.

1039 * 1

1037.75 * 3

1036.75 * 5

Out 1042.50

$2310.60 after commission.

From looking at the chart, someone might see where the top of the fib lines are (1042.50) and ask “why did you draw the line there rather than at the first high of 1042.25?” The answer is because when price hit 1042.25 and started retracing, it didn’t retrace far enough to get to the first retracement (38%), so it didn’t really count as a “top.” If you draw the fib lines there, you’ll see that price doesn’t make the first retracement (the green line, I don’t know what that gray one that OEC draws is all about) and just continues higher.

You might also notice that, from the time price started retracing, there were multiple opportunities to go short (although I didn’t take them because I was already long, but that could have been an interesting hedging opportunity).

This afternoon was full of short winners, but I stopped after the trade this morning because I figured after being away from the game for months, I was content with a single winner for my first day back. Here’s a pic of the afternoon, but you’ll have to excuse the confusion on this pic because OEC draws fib lines to the right forever (as opposed to having them stop at the point on the Y axis where you drew the original line to). So I tried to annotate this pic with diagonal lines where they were drawn because right now it’s just a giant mess of lines. I probably wouldn’t have taken that last trade because 15 minutes before the market closes is way too close for comfort. I don’t want to get stuck with a position afterhours or overnight.

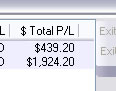

6/30 PnL: $2,310.60

All the trades I missed this afternoon.